- Private clients

- Corporate Customers

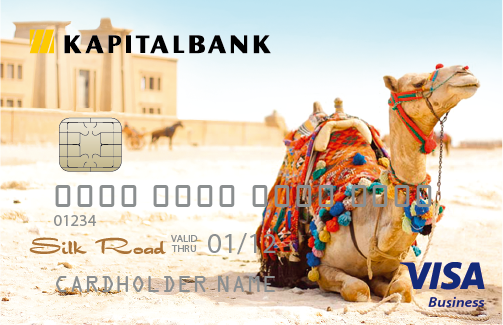

- Plastic cards

- Visa Business

International Corporate VISA Business plastic cards of Kapitalbank JSCB are modern and convenient!

By purchasing International Corporate VISA Business plastic cards, customers are provided with a high level of service and comfort.

Together with the International Corporate VISA Business plastic cards of Kapitalbank JSCB, you acquire:

- Security of payments and storage of funds

- Saving time on recalculation of bills in the calculations

- No need to carry bulky bundles of cash

- Accuracy in calculations

Scope of application of International Corporate VISA Business plastic cards of Kapitalbank JSCB. With the help of cards you can:

- Pay for travel expenses

- Pay for goods and services in trade and service enterprises where trading terminals are installed

- Receive cash at bank cash desks and ATMs (outside the Republic of Uzbekistan)

- Replenish money from the organization’s settlement account to the card account

|

|

Bank service/ Condition of service |

Commission rate of the Bank, charged to client for Bank's transaction performance |

Note |

|

a) |

Issue/re-issue of the main card or additional card |

UZS 30,000 |

|

|

b) |

Card reissue upon card expiration |

Free |

|

|

c) |

Card expiry date |

3 year |

|

|

d) |

Processing of transactions of payment for goods and services |

Free |

|

|

e) |

Replenishment of a corporate card through a client bank |

0.5% of the transaction amount |

|

|

f) |

Cash withdrawal outside the Republic of Uzbekistan |

2% of the amount, min 1 USD |

|

|

g) |

Investigation on account and transactions |

up to $100 - 5 (five) USD (at the rate of CB); |

|

|

|

The following operations are not allowed:

Connection and provision of 3D Secure service is carried out automatically, with no commission. |

-

To prevent others from using your card, keep the PIN code separate from the card, do not write the PIN code on the card, do not tell the PIN code to any other person. When entering a PIN code on an electronic terminal or ATM, do this so that the entered numbers are not visible to others.

-

Periodically check the card account transactions-this can be done on the statements received from the Bank, as well as using the free SMS informing service by sending an appropriate SMS message to the number 2212. In case of detection of suspicious or unknown transactions, immediately report it to the Bank. The list of SMS notification commands can be found here - > INSTRUCTIONS

-

In case of loss of the card (loss, theft, withdrawal) or, if the information about the PIN code or details of the card became available to third parties, immediately put the card on the STOP list using the service of SMS informing by sending an appropriate SMS message to the number 2212, as well as urgently contact "Kapitalbank" and inform about the loss of the card orally or in writing.

-

In order to avoid fraud with Your card, require operations with it only in Your presence, do not allow it to be taken out of your field of vision.

-

When receiving cash at the ATM, make sure that the ATM is installed in a well-lit place or a special room of the Bank, do not carry out operations in ATMs that are installed in deserted places. Examples of installation of the devices for reading card data

- The original document proving the identity

- Agreement between the Bank and a legal entity

- Agreement between the Bank and an individual

- VISA Card opening - to 4 p.m.

- EMV SMART VISTA Cards cash withdrawal - to 4p.m.,

- Other operations - to 5 p.m.